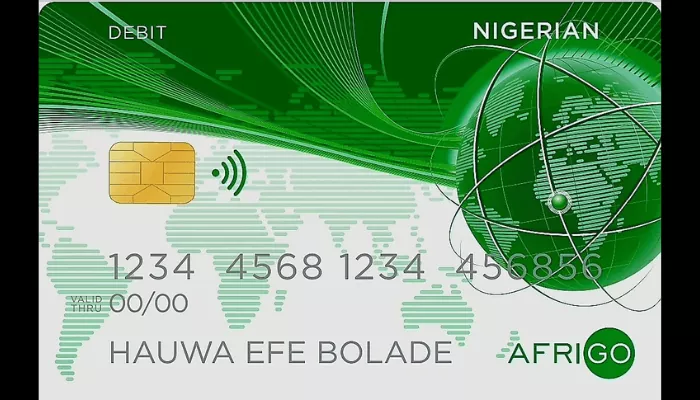

The introduction of Afrigo, which is a collaborative effort of the Central Bank of Nigeria and the Nigerian Inter-Bank Settlement Systems (NIBSS) is another step in the CBN’s cashless policy drive. According to the CBN Governor, Mr. Godwin Emiefele, Afrigo is a complement to international card schemes like Mastercard and Visa which have foreign exchange requirements that result in high card cost charges and do not address the local peculiarities of the Nigerian market.

Afrigo seeks to deepen financial inclusion, lessen cost of transactions and enhance data sovereignty and track spending. With this initiative, Nigeria joins countries like Japan, Russia, Brazil and India, who have launched domestic card schemes, because of its transformative benefits for their respective payments and financial systems, particularly for the under-banked.

One factor behind the success of domestic payment card schemes is that they have an excellent understanding of their target group of customers and the financial difficulties they might face, particularly in countries with significant unbanked populations. Overall, limited international functionality on domestic scheme-branded cards is not considered a significant issue, as their cardholders do not tend to travel outside the country of issuance. There are lower processing costs, both for issuers and acquirers.

Various countries have creatively used their domestic payment card schemes, Russia using it to pay its public servants, Japan using it to offer its citizens rebates on public transportation and domestic tourism and India’s Ru Pay being utilized for bill payments, ticketing systems for public transportation and cross border remittances. It would be interesting to see what unique peculiarities in the Nigerian market Afrigo would address in the coming days.

Authored by:

Vivienne Sar

Director General

The Center